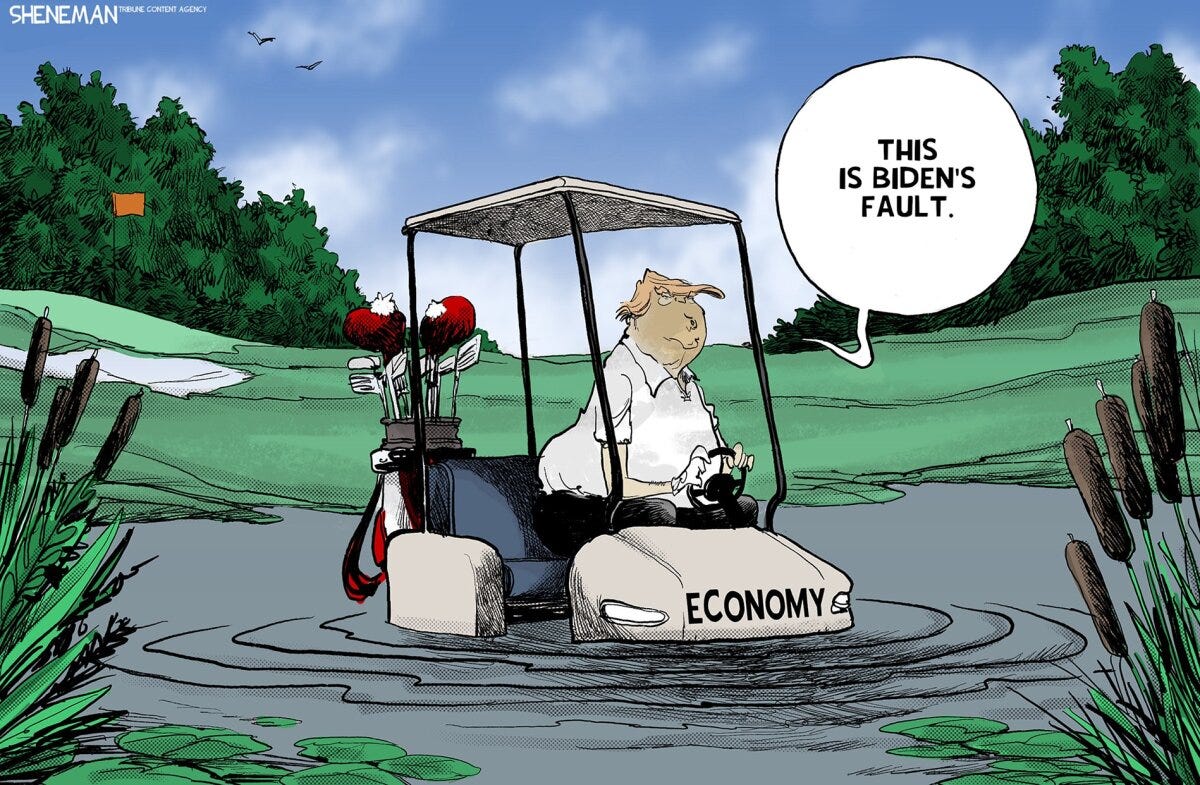

Yet another week of Trumponomics!

As usual, Trump once again passes the buck, takes no responsibility for the mess he has created as this week he posted on his Truth Social:

“This is Biden’s Stock Market, not Trump’s. Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers. Our Country will boom, but we have to get rid of the Biden ‘Overhang.’ This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!”

Trump says it’s Biden’s economy, but businesses and economists beg to differ. Maybe his cult believes this nonsense, but I don’t believe anyone, who has been following the inane decisions he has made over the last 100 days would agree.

U.S. economy went into reverse in the first quarter, new GDP data shows

Oh. what dealmaker he is!

When ghostwriter Tony Schwartz began writing “The Art of the Deal,” he realized that he needed to put an acceptable face on Trump’s loose relationship with the truth. So he concocted an artful euphemism. Writing in Trump’s voice, “I play to people’s fantasies. . . . People want to believe that something is the biggest and the greatest and the most spectacular. I call it truthful hyperbole. It’s an innocent form of exaggeration—and it’s a very effective form of promotion.”

Schwartz now disavows the passage. “Deceit,” is never “innocent. ‘Truthful hyperbole’ is a contradiction in terms. It’s a way of saying, ‘It’s a lie, but who cares?’” The New Yorker

White House officials have boasted that more than a dozen countries have put offers “on the table” to avoid the tariffs scheduled to start in about two months. However, according to foreign diplomats, they are simply preliminary outlines about what they want to discuss – rather than trade deals.

Some trading partners are balking at proposing even an outline of their terms before they get more guidance from the U.S. side on what Trump is seeking from the talks. They want to see what Trump has in mind before they start negotiating. Not surprisingly, they don’t trust Trump and are not sure what he wants to do.

Even with the three-month pause on the reciprocal tariffs, the U.S. economic outlook is sinking under the weight of Trump’s existing tariffs on China, autos, steel and aluminum, raising pressure on the White House to show progress on its trade talks.

Trump claimed last week he has already struck 200 trade deals. Ironic since there are only 195 countries in the world. One can only wonder with whom he has all these “deals.” A representative for the White House declined to comment on foreign diplomats’ characterizations of those proposals.

“More than anyone else I have ever met, Trump has the ability to convince himself that whatever he is saying at any given moment is true, or sort of true, or at least ought to be true.” ~Tony Schwartz

One diplomat presented with the program was dismissive of that plan: “It’s merely a timetable that no one believes. I don’t know of anyone that may be taking things more seriously.”

Diplomats from several countries said they are uncertain about what would be enough to appease the White House and whether it would make much of a dent in the sweeping tariff agenda Trump has imposed on nearly every country.

“To be frank, it’s still not completely clear what the U.S. really wants. They ask a very disparate number of different things,” said one European diplomat, who described the talks as in the discussion phase. “So we are still trying to figure out what are the real priorities from the U.S.”

(Source of this text is from Politico)

Alas, another week of economic uncertainty thanks to our Felon in Chief….

Thought for the day in honor of his birthday…

“The first method for estimating the intelligence of a ruler is to look at the men he has around him.”

~ Niccolo Machiavelli

Must Read Article

What Would Be Worse Than a Recession?

Recessions are miserable, in terms of businesses destroyed, start-ups abandoned, lifetime earnings depressed, and lives lost. Yet a downturn might be the least of the damage done by the second Trump administration. The White House’s confused policy aims and inane policy processes—as well as its disregard for the rule of law and common sense—are leading investors to dump American assets. Stocks, bonds, and the dollar are declining in tandem. The United States’ hegemony over the financial markets is at stake….

Business leaders are perplexed and paralyzed. Will the existing tariffs remain in place? Will the Trump administration implement additional trade barriers? Will foreign countries band together and pass tit-for-tat levies? Is a recession imminent or already here, if still invisible in the headline economic figures? Executives are struggling to figure out how much to invest, how many goods to stockpile, and how many workers to keep on…

…investors are not wrong that the United States has changed, and that American markets might be less safe and less secure in the future. And Americans might miss their exorbitant privilege when it is gone.

Quote of the day…

"Well, maybe the children will have two dolls instead of 30 dolls, and maybe the two dolls will cost a couple of bucks more." — Donald Trump, April 30, 2025

“I hesitate to speak for Trump voters, but I’m skeptical that this is what they thought the Golden Age would actually mean. And yet there was our billionaire president — surrounded by the golden gaud of his Trumpified Oval Office — telling the masses to go without, do with less, and pay more for it.

‘Let them have cake,’ suggested Marie Antoinette. ‘Let them have two dolls,’ suggested Donald Trump, as his tariffs slouch toward what looks to be an especially stingy Christmas.”

~Charlie Sykes

What I’m reading….

Inside Trump's 100 days of presidential profit

Trump's family has enjoyed a historically lucrative first 100 days, leveraging its proximity to power — and raking in billions — through a flood of ethically murky business ventures.

Most presidents try to avoid even the appearance of using the office or public policy for personal enrichment.

But Trump has blended official power and personal business in unprecedented ways — and often in plain sight.

What's happening: Trump, his sons and their associates have launched a wave of high-dollar projects monetizing their proximity to the most powerful government in the world.

Secret Deals, Foreign Investments, Presidential Policy Changes: The Rise of Trump’s Crypto Firm

Mr. Trump’s return to the White House has opened lucrative new pathways for him to cash in on his power, whether through his social media company or new overseas real estate deals. But none of the Trump family’s other business endeavors pose conflicts of interest that compare to those that have emerged since the birth of World Liberty.

The firm, largely owned by a Trump family corporate entity, has erased centuries-old presidential norms, eviscerating the boundary between private enterprise and government policy in a manner without precedent in modern American history.

How tariffs can cause a recession

If you were president of the United States and wanted to engineer a recession by summer, at least one economist says a very effective way of doing that would be to announce sweeping "Liberation Day" tariffs in April. That's the message of a new 40-page slide deck from Apollo chief economist Torsten Slok, entitled "The Voluntary Trade Reset Recession," the probability of which he now puts at 90%.

"Baby tax": Trump tariffs send baby gear prices soaring

New parents looking to purchase a stroller may want to get a jump start, as the price of baby gear is climbing thanks to President Trump's tariffs. The president has become a powerful ally in the push for women to have more children but his roller-coaster tariffs have made it more expensive for parents to buy the baby products they need, industry leaders say. Prices on baby essentials, like car seats and strollers, started increasing last week and are up, on average, by about 30%.

From “America First” to “Sell America”

In certain parts of the economy, though, cracks are appearing, particularly in areas where spending is discretionary. Announcing Delta Air Lines’ latest quarterly financial results, the company’s leader, Ed Bastian, said that “growth has largely stalled.” Scott Boatwright, the boss of Chipotle, said the fast-casual restaurant chain has seen “a slowdown in consumer spending,” which he attributed to people “saving money because of concerns around the economy.”

Key commodity exports plunge as Trump's trade war bites

Sales to China of key commodities, like soybeans and pork, are plunging as the trade war begins to impact the domestic economy. U.S. farmers export more than $176 billion in agricultural products annually — almost 10% of which is just soybean and pork shipments to China. Losing even a fraction of those exports for the long term could be economically devastating.

In the week of April 11-17, net soybean sales were down 50% week over week and down 25% versus the four-week average, per data from the U.S. Department of Agriculture's Foreign Agricultural Service.

Naming the Biggest Winners From Trump’s Disastrous First 100 Days

Oddly, though, as of 100 days into Trump 2.0, the big winner is neither Trump, nor his family, nor his cronies, nor his sponsors in the Kremlin, nor the maker of his many pairs of man spanx. They’ll all do just fine, of course. But someone has done much better. Someone is winning by standing up to Trump and will almost certainly end up winning by cutting a deal with Trump, someone is winning because they are gaining stature at home and because they are gaining stature abroad. They are winning because almost every move Trump makes—from his trade wars to pulling out of international institutions, from betraying our allies to supporting our enemies, from attacking science and research in America to gutting American education, from switching off the beacon of democracy to eliminating our soft power influence, from the consequences of putting nitwits and lizard people in charge of our government to the long-term implications of ending our ability to attract the world’s best and brightest minds. No, there is no question. By far the biggest winner of all the winners Trump has made is Chinese President Xi Jinping, and by extension all the people of China.

The US and China are on a collision course, and nations are being forced to choose sides

As Trump’s trade war locks the world’s two largest economies on a collision course, America’s unnerved allies and partners are cozying up with China to hedge their bets. It comes as Trump’s trade push upends a decade of American foreign policy — including his own from his first term — toward rallying the rest of the world to join the United States against China. And it threatens to hand Beijing more leverage in any eventual dialogue with the U.S. administration.

Something Alarming Is Happening to the Job Market

According to the New York Federal Reserve, labor conditions for recent college graduates have “deteriorated noticeably” in the past few months, and the unemployment rate now stands at an unusually high 5.8 percent. Even newly minted M.B.A.s from elite programs are struggling to find work. Meanwhile, law-school applications are surging—an ominous echo of when young people used graduate school to bunker down during the great financial crisis…That is, today’s college graduates are entering an economy that is relatively worse for young college grads than any month on record, going back at least four decades.

Market turmoil has many afraid to check retirement savings

As the White House simultaneously injects turmoil into financial markets with its trade war and dismisses fears of a downturn, retired and near-retired Americans are anxiously looking on, worried about outliving their savings or having to put off entries on their bucket lists….

Oats Estridge, who lives in Dayton, Ohio, retired from a job in software engineering... Her account is down more than $40,000 and she gets angry thinking about how some in Washington have reacted to the market volatility, including Trump’s recent market assessment that it was “a great time to buy.”

“Where am I supposed to come up with the money to buy? My underwear drawer?” Oats Estridge asks.

Musk’s DOGE Goons’ Total Failure to Cut Spending Revealed

With the clock ticking on his DOGE tenure, Musk and his goons have only saved the government an estimated $160 billion, which accounts for a mere 8 percent of his projected $2 trillion in savings. On top of that, the Penn Wharton Budget Model found that government spending has actually gone up… total spending climbed by 6.3 percent or $156 billion since President Donald Trump returned to office in January, compared to the first four months of 2024. Even when accounting for inflation, the government still spent $81.2 billion more under Trump compared to the same period last year.

Want Efficiency? Fund the VA and Cut the Proven Waste in Privatized Veterans Care

Studies comparing care delivered for a multitude of conditions within and outside the VHA confirm that type of private-sector waste. When ambulances randomly transported veterans to either VHA or private emergency departments, private care cost 21% more -- primarily due to unnecessary electrocardiograms, inpatient admissions, and evaluation and management services with higher reimbursement rates. Diabetic veterans rack up greater costs in the VCCP, largely from increased inpatient expenses and prescription drugs. Low-risk prostate cancer patients in the VCCP are twice as likely as those in the VHA to receive unneeded surgery or radiation, costly procedures that also carry significant risks. The private sector performs more "guideline discordant," "questionable" and "low-value" tests than the VHA, which then lead to more unnecessary services downstream, higher health-care costs and potential harm to the patient.

Companies Are Serving Notice: We’re Raising Prices Because of Tariffs

Some company officials said they had been left with no choice but to raise prices as they pay more to import goods and materials into the United States. Other firms have said they will soon run out of inventory for certain products because they have paused orders from China. Trump has upended the global trading system, hitting foreign countries with punishing levies in an attempt to bring manufacturing jobs back to the United States and take aim at what he calls “unfair” trade practices. But economic studies have found that the burden of higher tariffs typically falls on domestic consumers and companies.

Retailers Fear Toy Shortages at Christmas as Tariffs Freeze Supply Chain

Toy makers, children’s shops and specialty retailers are pausing orders for the winter holidays as the import taxes cascade through supply chains. Factories in China produce nearly 80 percent of all toys and 90 percent of Christmas goods sold in America. The production of toys, Christmas trees and decorations is usually in full swing by now. It takes four to five months to manufacture, package and ship products to the United States. Mr. Trump’s 145 percent tariffs have caused a drastic markup in costs for American companies.

Amazon is not planning to break out tariff costs online as White House attacks potential move

Amazon says it’s not planning to display added tariff costs next to product prices on its site — despite a report that sparked speculation the e-commerce giant would soon show the new import charges, and the White House’s fiery comments denouncing the purported change.

The Trump administration’s reaction appeared to be based on a misinterpretation of internal plans being considered by Amazon, rather than a final decision made by the company.

Trump’s Tariffs Won’t Bring Back Manufacturing Jobs

Because Trump waged a (relatively scaled-down) trade war during his first term, we have ample evidence to assess the current conflict. US Federal Reserve economists Aaron Flaaen and Justin Pierce estimate that US manufacturing-job losses due to costlier inputs were five times larger than manufacturing job gains from import protection during the 2018-19 trade war.

What I’m watching…

What I’m listening to…

Tariffs are driving consumer confidence down, firms are talking about cutting back on hiring and investments, and Goldman Sachs is predicting that the U.S. will have the highest inflation and lowest growth of any developed economy this year. Plus, Scott Bessent is not a calming influence, and Trump has a real 'War on Christmas' in the works.

The childishness.