“Housing is stability. Housing is dignity. Housing is absolutely necessary, critical infrastructure.” ~Raphael Warnock

I have had several careers in my life. The most recent was that of a residential real estate agent. I wanted to have a lifestyle, where I could run my own business and work from home. It turned out to be a good fit. I also found out and grew to appreciate, that despite what most people think, it’s an incredibly challenging job… far more than I thought it was going to be; particularly during the period after the financial meltdown in 2008.

During the early part of the 2000s it was go, go, go… Developers were building spec houses, multiple offers abounded, people were moving and upgrading their homes, Gen Xers were buying their first starter homes. It was a busy time for real estate agents and mortgage lenders. But sadly, much of it was based on a mortgage system, that led to incredibly flawed loans, which then led to the great collapse.

Many of us felt immense financial pain during those years — myself included. I’ve tried to block it all out — maybe you have too. So, if you want a reminder, just stream The Big Short.

The fallout for the residential real estate community was profound. Many of my colleagues had to give up their businesses and look other employment, because they couldn’t put food on their tables… some lost their homes. I had to take on part-time consulting gigs and take out funds from my retirement savings just to make ends meet. I know builders, who lost multi-million-dollar spec homes, because they couldn’t pay their loans. Some even went out of business. It was a really ugly time.

One of the repercussions of the housing crisis, was the halt of new construction. Not enough homes were built after 2008 to meet the needs of today’s population.

As a result “homes of all types are currently unaffordable to many working people nationwide. In large part, this reality stems from simple supply and demand. Since the 2008 Great Recession, the country hasn’t built enough housing to keep up with population growth. Slow local approval processes, byzantine zoning laws, and, recently, high interest rates have all stymied new construction. The result: We need an estimated 3.9 million more housing units to meet existing demand.” (source: Urban Institute)

Today we’re feeling that pain everywhere in this country. There are simply not enough affordable homes for the number of people, who need them. Though interest rates are not excessive, they are certainly higher than they were a few years ago making the average month’s mortgage payment challenging — particularly for many home buyers.

Since I moved to Asheville, I’m still getting feeds from various websites like Redfin, Realtor.com, Zillow, etc. I like to follow the local market and keep abreast of the value of my home; see cool houses that come on the market; and, generally, get a sense of the real estate in my new hometown.

Now, I know that there is a housing shortage in Asheville - actually in much of Western North Carolina (FEMA maps suggest that over 1,000 homes were destroyed in North Carolina due to Hurricane Helene.) I also know that prices have risen dramatically since Covid. With that said…

…This morning a new feed came up for a house for sale here in Asheville. I know that sellers will list their house for whatever they want, in spite of recommendations from their agent. Regardless, I was dumbfounded and took a second look at this particular listing:

2 beds, 1 bath, 1,612 sqft, 8,712 sqft lot, 1948 built

I looked more closely at the pictures. It looked sort of cute (albeit not that cute), but it was located on one of the busiest, noisest streets in Asheville.

Asking price $409,000. True.

This is not New York or California — this is North Carolina. I couldn’t believe the asking price.

I’ve been reading a lot of articles about the affordable housing shortage in the United States. I’ve been listening to younger family members, who are struggling to make their rent in various parts of the US. So I know there is a problem. But somehow this little listing shocked me into understanding the problem better.

What is happening in our housing market when a nearly 80-year-old, 2BR/1BA home situated on a major thoroughfare is being listed for close to a half-million dollars? OMG.

And what is the Trump adminstration doing about it?

Approximately 30% of the construction workforce in the United States is comprised of immigrants. This translates to roughly 1.6 million immigrant workers in the construction industry. In certain states and locations, this percentage can be even higher. For example, in New York City, it's estimated that 63% of the construction workforce are immigrants. We’ve all seen how the Trump Adminstration feels about immigrants. One can only wonder what their mass deportation plan is going to do to labor costs on construction projects.

Trump has promised to open federal land for construction, with zones featuring "ultra-low tax and ultra-low regulations." While that sounds interesting, I question the practicality of building large-scale housing in areas like South Dakota, Alaska, Montana, New Mexico, etc. It’s worth noting the proposal was coming from the Energy committee not the housing committee. Furthermore, deregulation alone may not solve the affordable housing crisis. Cooperation across local, state, and federal policymakers is essential to address various cost drivers like land, borrowing, materials, labor, and insurance.

They are proposing budget cuts to HUD, including the reductions in the workforce and funding for programs that support affordable housing construction and rehabilitation. “Despite this need, the administration has signaled in its recent budget proposal to Congress that it would like to eliminate US Department of Housing and Urban Development (HUD) programs that subsidize developers, instead pushing these costs to state and local governments. However, doing so risks falling further behind on much-needed housing supply, as the national need is too large and state and local government budgets are too constrained to fill the gap.” (Source: Urban Institute)

Trump is promoting international tarrifs. Building materials in the US are heavily reliant on imports, such as steel, aluminum, lumber, and electrical components. These products are most likely to be impacted by Trump’s tariffs. Tariffs can significantly lead to higher construction costs and potentially affecting housing affordability.

“Based on the FY2026 budget proposal released by the White House in May 2025, it is clear that the Trump Administration seeks to abdicate the federal government’s responsibility for ensuring a strong social safety net. This budget will not ensure that the most vulnerable Americans have access to the most basic things for survival, including housing. The proposed policy changes, funding cuts, and total elimination of critical programs for low-income and vulnerable Americans, if enacted, would only worsen homelessness and exacerbate already-overwhelmed homelessness response systems.” (source: National Alliance to End Homelessness)

Based on his Big Beautiful Bill, we have a pretty clear idea as to his priorites when it comes to housing needs: +265% more in funding for ICE detention centers, while cutting the HUD budget by -44%.

During his campaign, #FOTUS made several promises related to housing affordability and the housing market.

Trump pledged to "Make Housing Affordable Again".

He promised to eliminate federal regulations that he argued were driving up housing costs.

The Republican platform, supported by Trump, emphasizes promoting homeownership through tax incentives for first-time homebuyers.

He claimed that he would bring down mortgage rates by "slashing inflation."

He vowed to open portions of federal land for large-scale housing construction.

Trump promised to ban mortgages and end housing benefits for unauthorized immigrants, redirecting those funds to house homeless veterans.

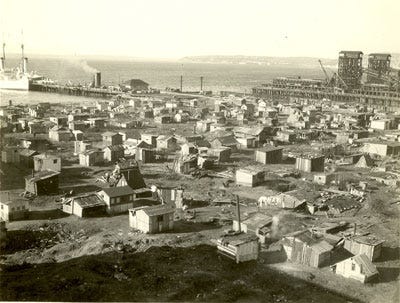

During the Great Depression, Hoovervilles became prevalent in many cities to accommodate all the people who had lost their homes. The name "Hooverville" was a term meant to mock President Herbert Hoover for his perceived inaction in addressing the economic crisis and the resulting poverty.

I can’t help but see some of the parallels to that time. Maybe we should start calling our great real estate developer’s new housing products, Trumpvilles, as this appears to be Trump’s solution to our housing crisis.

Hum…

I wonder if he plans to put the TRUMP sign somewhere on these buildings — like he did in Chicago (Windy City Eyesore)!

Thought for the day in honor of his birthday…

“So this is America. They must be out of their minds.”

~ Ringo Starr

Must Read Article:

The Whole Country Is Starting to Look Like California

Home prices have been rising most sharply in the exact places that have long served as a refuge for Americans fed up with the spiraling cost of living. Over the past decade, the median home price has increased by 134 percent in Phoenix, 133 percent in Miami, 129 percent in Atlanta, and 99 percent in Dallas. (Over that same stretch, prices in New York, San Francisco, and Los Angeles have increased by about 75 percent, 76 percent, and 97 percent, respectively)…

In a properly functioning housing market, the post-COVID surge in demand should have generated a massive building boom that would have cooled price growth. Instead, more than five years after the pandemic began, these places still aren’t building enough homes, and prices are still rising wildly…

Some argue that the wave of consolidation within the home-building industry following the 2008 financial crisis gave large developers the power to slow-walk development and keep prices high. Others say that the cost of construction has climbed so high over the past two decades that building no longer makes financial sense for developers.

Quote of the day:

“California’s housing crisis has been metastasizing for decades; I don’t know if one change is going to have a big impact right away. I have much more hope for the Sun Belt states… a lot of those cities aren’t that far gone. Raleigh, North Carolina, recently responded to the demand for housing with a slate of new reforms that made it much easier to build apartments and dense housing in more places, especially near transit.”

~ Rogé Karma

What I’m reading today…

The current housing market is skewed toward producing high-priced housing. New development has become more expensive because of increases in labor costs, borrowing costs, and costs accrued by time to navigate local approvals. To make their investment pencil out, developers must charge high prices for the homes they build.

How Progressives Froze the American Dream

Today, America is often described as suffering from a housing crisis, but that’s not quite right. In many parts of the country, housing is cheap and abundant, but good jobs and good schools are scarce. Other areas are rich in opportunities but short on affordable homes. That holds true even within individual cities, neighborhood by neighborhood.

As a result, many Americans are stranded in communities with flat or declining prospects, and lack the practical ability to move across the tracks, the state, or the country—to choose where they want to live. Those who do move are typically heading not to the places where opportunities are abundant, but to those where housing is cheap. Only the affluent and well educated are exempt from this situation; the freedom to choose one’s city or community has become a privilege of class.

Against the odds, Gen Z is breaking into the housing market

Despite daunting market conditions, America’s youngest generation of adults is managing to break into the housing market in growing numbers. Members of Generation Z, the cohort between the ages of 13 and 28, came of age during the economic upheaval of the Covid-19 pandemic. In the years since, home prices have surged and the nation’s housing shortage has deepened — conditions that risk leading some young adults to give up on the dream of homeownership altogether. Still, many in Gen Z are forging ahead with homeownership.

Housing Market Hits Troubling Milestone for First Time in Nearly 20 Years

Buying an entry-level home in the U.S. now costs more than twice as much per month as renting, according to a new study by John Burns Research and Consulting (JBREC)—showing that the housing affordability gripping the country is far from easing up despite rising inventory.

It is the first time in nearly 20 years, since 2006, that the monthly cost of owning an entry-level home is more than double the average apartment rent in the country—a grim reminder of a time when the U.S. housing market was on the cusp of collapsing.

Downtown Housing Could Rise in California Cities, but Barriers Remain

Officials waylaid a project to build 10 townhouses in part because of concerns that it might cast shadows on a nearby playground. A man who wanted to build in the city’s Mission District had to commission a 137-page report to prove the laundromat he was demolishing was not a historic site. City leaders voted against a plan to build 500 apartments on a Nordstrom parking lot, citing the risk of gentrification.

Similar projects, building experts said, could benefit the most after Gov. Gavin Newsom and state lawmakers on Monday significantly scaled back the California Environmental Quality Act. The 55-year-old law, known as CEQA, is considered a bedrock of the state’s environmental protections, yet has often been employed by neighbors and disaffected parties as a way to oppose any project to which they took exception.

How an empty North Carolina rural hospital explains a GOP senator’s vote against Trump’s tax bill

Though patients don’t rush through the doors of this emergency room anymore, an empty hospital in Williamston, North Carolina, offers an evocative illustration of why Republican Sen. Thom Tillis would buck his party leaders to vote down President Donald Trump’s signature domestic policy package. Martin General is one of a dozen hospitals that have closed in North Carolina over the last two decades. This is a problem that hospital systems and health experts warn may only worsen if the legislation passes with its $1 trillion cuts to the Medicaid program and new restrictions on enrollment in the coverage.

3 housing-market warning signs that economists are monitoring

Existing home sales dropped 0.7% year-over-year in May. That came after a particularly sluggish April, with homes making their way off the market at the slowest pace in 16 years, according to the National Association of Realtors. The situation is worse for new home sales, which dropped almost 14% in May.

As in medieval times, the affluent withdraw behind barriers. … Today, gated communities encompass 14 million housing units. On its website, a real-estate company in Florida earlier this year asked readers, “Is a Moat Right for You?” It was an April Fools’ joke, but not a very good one, because modern moated residences already exist. Perhaps the most exclusive gated community in the world is actually an island—Indian Creek Village, in Biscayne Bay, Florida, with 89 residents (including Jeff Bezos, Ivanka Trump, and Jared Kushner) and a perimeter-security radar system designed by the Israeli company Magos. Officers in speedboats intercept anyone venturing too close.

Roughly 70 Florida National Guard troops have been deployed to the newly built, remote immigration detention site deep in the Florida Everglades dubbed "Alligator Alcatraz" as the Trump administration leans harder on the military to enforce its nationwide immigration crackdown.

Crypto Industry Moves Into the U.S. Housing Market

The nation’s largest mortgage finance firms will begin accepting crypto as an asset on a mortgage application, another significant step by the Trump administration to bring digital currencies into mainstream finance.

President Trump’s housing director, William Pulte, said he would direct Fannie Mae and Freddie Mac — the nation’s big mortgage finance firms — to consider home buyers’ crypto investments as part of their overall wealth in assessing whether they can afford a mortgage. Traditionally, a home buyer’s cash savings and stock investments are what mortgage lenders consider.

Map Shortage as a Percent of the Housing Stock: County-level

A book I highly recommend…

The Remains of the Day by Kazuo Ishiguro

The home, Darlington Hall, serves as a powerful symbol and a catalyst for reflection on themes of duty, regret, and the changing social landscape. Wonderful book.

What I am listening to…